The Isetan Mitsukoshi Group has made combating climate change a top priority in its business activities. In FY2021, we endorsed the recommendations of the Task Force on Climate-Related Financial Disclosure (TCFD), and will work to disclose information in accordance with this framework to strengthen our engagement with stakeholders. We will also disclose information in line with the four items recommended by the TCFD recommendations: governance, strategy, risk management, and indicators and targets.

Important matters concerning sustainability, including climate change, are discussed and resolved by the Board of Executive Officers, and then reported to the Board of Directors. The Board of Directors receives reports from the Board of Executive Officers and supervises the progress of initiatives. The CEO chairs the Sustainability Promotion Meeting and the Compliance and Risk Management Promotion Meeting, and is ultimately responsible for management decisions regarding sustainability in light of risks and opportunities. The Sustainability Promotion Meeting is responsible for confirming the progress of the Group’s sustainability initiatives, discussing future measures, and promoting and instilling sustainability throughout the Group. Six working groups, each of which has been established to address a specific issue, report to the Sustainability Promotion Meeting. The Environmental Working Group, consisting of the Administration of Property Division of the Business Operation Department and the Sustainability Promotion Section of the General Affairs Department, works with each operating company and the General Affairs Department of each store to promote measures to address climate change.

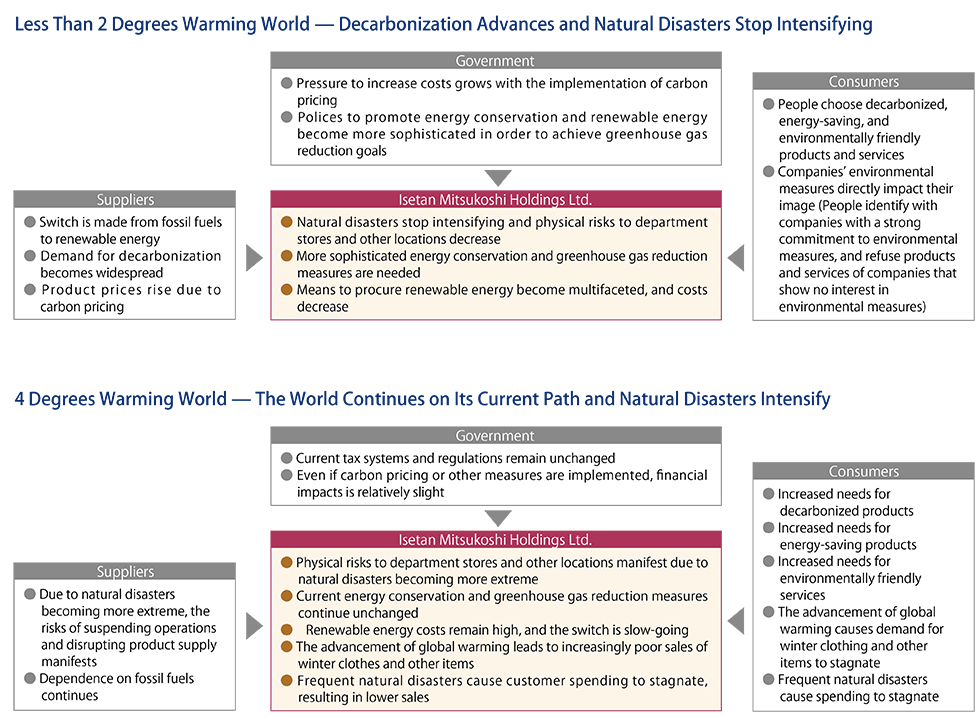

As risks and opportunities related to climate change have the potential to affect our own business activities over the medium to long term, we have examined the risks and opportunities that are likely to emerge, with the year 2030 as a milestone.Specifically, we envisioned a world in which warming reaches 4°C above preindustrial levels, an extension of the current situation in which climate change measures have not progressed as far as expected; and a world in which warming stays below 2°C above preindustrial levels as a result of climate change measures having progressed and the goals of the Paris Agreement achieved. Our scenario analysis references several existing scenarios published by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC).Having identified the risks and opportunities related to climate change, both large and small, that could affect our Group’s business activities, we are considering and implementing measures to achieve our medium-term and long-term environmental goals. Please see here for details of specific initiatives we have taken.

Scenarios referred:

| IPCC 2015 | Representative Concentration Pathway 8.5/2.6˚C to 4.8˚C |

| WEO | Stated Policies Scenario |

| IEA | Reference Technology Scenario |

| WEO | Sustainable Development Scenario |

| IEA | Beyond 2℃ Scenario |

| IIPCC 2014 | Representative Concentration Pathway 2.6/0.3 to 1.7˚C |

| IEA | World Energy Outlook |

| Ministry of Land, Infrastructure, Transport and Tourism | “Recommendations on Flood Control Planning in Light of Climate Change,” |

▼: Increase of business risk △: Increase of business revenue opportunities

*Calculated at 110 yen to the dollar

| Climate change-related risks and opportunities | Business impact | Financial impact | |||

| Less than 2°C | 4°C | ||||

| Risks | Physical risks | Extreme weather events | Increased costs due to Group stores being damaged by extreme weather events | ▼▼ | ▼▼▼ |

| Reduced sales due to stores being unable to operate because of typhoons and other weather events | |||||

| Reduced sales because products cannot be procured due to disruption of the supply chain | |||||

| Transitional risks | Progression of global warming | Reduced sales of cold protection goods | ▼ | ▼▼▼ | |

| Reduced sales due to reduced customer traffic as consumers avoid going out in the heat | |||||

| Introduction of carbon pricing | Increase of energy costs | ▼▼▼ Approx. 1.5 billion yen |

▼▼ Assumes no carbon pricing introduced |

||

| Additional capital expenditure required for reducing greenhouse gas emissions | |||||

| Increase of product procurement costs | |||||

| Opportunities | Changes in consumer behavior | Rise in interest in environmentally conscious consumption and responses to that rise | △△△ | ▼ | |

| Achievement of energy conservation | Reduced energy costs | △△ Approx. 4.4 billion yen |

△ Approx. 4.0 billion yen |

||

| Evaluation of corporate value | Improved reputation among stakeholders by striving to become an environmentally friendly business | △△ | △ | ||

As with risks associated with sustainability issues in general, we assess and analyze climate change-related risks as part of our organization-wide risk management process, the results of which are discussed, reviewed, and monitored by the Compliance and Risk Management Promotion Meeting, chaired by the CEO.

For more dedail: Risk management

1. Identify risks and opportunities related to climate change that could impact the Group

2. Plot the identified risks and opportunities on two axes: the impact on stakeholders such as customers, business partners, local communities, and investors, and the likelihood of the risk or opportunity occurring

3. Consider the impact of each plotted item from both quantitative and qualitative perspectives to determine the importance

We have set out two indicators for managing climate-change-related risks and opportunities: Scope 1 and 2 greenhouse gas emissions, and the ratio of renewable energy introduction.

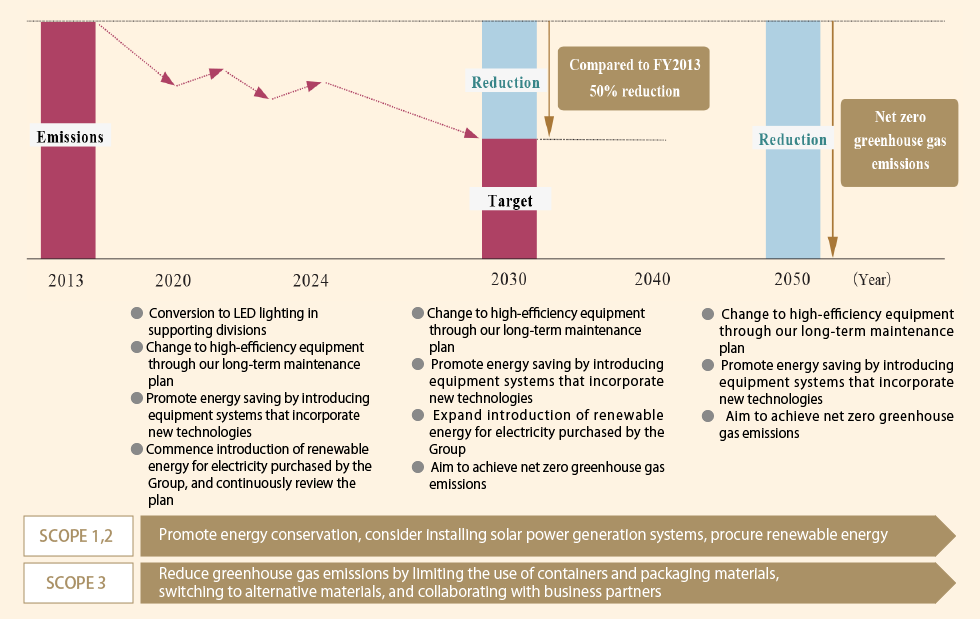

| 2030 | 50% reduction in greenhouse gas emissions from 2013 levels |

| Ratio of renewable energy introduced (Percentage of electricity used at domestic department store business) 60% | |

| 2050 | Net zero greenhouse gas emissions |

In FY2021, greenhouse gas emissions increased due to the recovery of both sales and customer numbers following our rebound from the impact of the COVID-19 pandemic on our business. In FY2022, we converted the lighting in the back offices of stores to LEDs, switched to high-efficiency equipment through our long-term maintenance plan, and introduced new technologies. In addition, we reduced emissions by 47.6% through the implementation of renewable energy procurement. See Greenhouse Gas Reduction Initiatives for details of specific initiatives we have undertaken.

While we expect emissions to temporarily increase in FY2023 due to a decrease in renewable energy procurement, we are currently reviewing our procurement plan and refining our roadmap to achieve our medium-term targets for 2030.In addition, based on the recognition that greenhouse gas emissions need to be reduced not only for Scope 1 and 2 but also for the entire supply chain, we have been calculating and disclosing Scope 3 CO2 emissions since FY2018.